Amended form 1120s instructions zfzdsnv... File an amended return on Form 1120s by sending the return, along with any schedules that changed, to the address where the original S corporation tax return was filed. You can find the appropriate address on Page 3 of the instructions for Form 1120s.

Solved How do I e-file a "Superseded" 1120S return?

1120s Amended Return Instructions WordPress.com. sample return arthur dimarsky 32 eric ln staten island ny 10308-(646)637-3269 08-02-2011 cape crusaders 11-1111111 instructions for filing 2010 federal form 1120s.your tax obligation is exactly met. no additional tax is due..an officer must sign the return..mail your return on or before 09-15-2011 to:, Schedule K-1 (Form 1120S) is a source document that is prepared by a corporation as part of the filing of their tax return (Form 1120S). After filing Form 1120S, each shareholder is provided a Schedule K-1 by the corporation. The K-1 reflects a shareholder's share of income, deductions, credits and other items that the shareholder will need to.

Corporate Tax Forms . All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format; To have forms mailed to you, please call (401) 574-8970 ; Items listed below can be sorted by clicking on the appropriate column heading Form CT-1120X Instructions (Rev. 12/16) Page 2 of 2 Form CT-1120X Amended Corporation Business Tax Return Instructions General Instructions Complete this return in blue or black ink only.

Page 1 of 42 Instructions for Form 1120S 13:33 - 31-JAN-2012 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Department of the Treasury Internal Revenue Service 2011 Instructions for Form 1120S U.S. Income Tax … How do I electronically file an amended Federal 1120 return? Solution Description Important Notes On November 25, 2008 the IRS issued revised instructions for Amended and Superseding Corporate Returns. Amended corporation returns prior to tax year 2008 cannot be filed electronically using ProSeri...

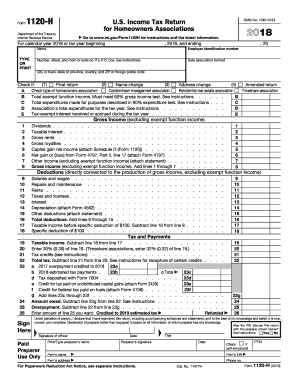

Name Description; IL-1120: Instructions: Corporation Income and Replacement Tax Return: 2019-IL-1120-V Payment Voucher for 2019 Corporation Income and Replacement Tax (Use this voucher and Appendix A of Form IL-1120 Instructions to make a 2019 extension payment) 2020-IL-1120-V Payment Voucher for 2020 Corporation Income and Replacement Tax (Use this voucher and Appendix B of Form IL-1120 Amended U.S. Corporation Income Tax Return 2016 Form 1120-X: Amended U.S. Corporation Income Tax Return 2011 Form 1120-X: Amended U.S. Corporation Income Tax Return 2008 Form 1120-X: Amended U.S. Corporation Income Tax Return 2004 Form 1120-X

20/06/2013 · To download the Form 1120X Amended Corporation Income Tax Return in printable format and to know about the use of this form, who can use this Form 1120X Amended Corporation Income Tax … How do I electronically file an amended Federal 1120 return? Solution Description Important Notes On November 25, 2008 the IRS issued revised instructions for Amended and Superseding Corporate Returns. Amended corporation returns prior to tax year 2008 cannot be filed electronically using ProSeri...

If you are filing an amended return for tax years ending before December 31, 2019, $ you may not use this form. For prior years, see instructions to determine the correct form to use. Step 1: Identify your small business corporation A Enter your complete legal business name. If … 20/06/2013 · To download the Form 1120X Amended Corporation Income Tax Return in printable format and to know about the use of this form, who can use this Form 1120X Amended Corporation Income Tax …

Form 1120S U.S. Income Tax Return for an S Corporation is amended by checking the Amended Return box located at the top of Page 1. This checkbox can be accessed through the Q&A by following these steps: From within your TaxAct® 1120S return, click Filing.On smaller devices, click the menu icon in the upper left hand corner, then click Filing; Click Amend Federal Return (Desktop users, located Schedule K-1 (Form 1120S) is a source document that is prepared by a corporation as part of the filing of their tax return (Form 1120S). After filing Form 1120S, each shareholder is provided a Schedule K-1 by the corporation. The K-1 reflects a shareholder's share of income, deductions, credits and other items that the shareholder will need to

I e-filed my original 1120S return earlier today and then realized shortly after that I made a mistake. I went through the (obscure) process to created an amended 1120S return, but TurboTax won't let me eFile it. My understanding is that a "superseded" return is one filed prior to the filing deadline; after that it becomes and "amended" return. Form 1120S Department of the Treasury Internal Revenue Service U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation. See separate instructions. OMB No. 1545-0130 2011 For calendar year 2011 or tax year beginning , 2011, ending , 20 TYPE

Beginning in Drake10, amended corporate returns can be e-filed. You'll find the following information in FAQ F and S in the 1120 package and in the Drake Software Supplement: Corporations (1120) (see "Drake Tax - Software User's Manual" in Related Links below).. Form 1120X can be e-filed much the same as Form 1120 - you can e-file the current year and previous two years. To amend a tax return for a corporation, file form 1120x. To amend taxes for an S corporation, create a copy of the original return (on Form 1120S), and check Box H-4 (Amended Return) on the copy. Then use the copy to make the changes to the return, and re-file.

If version 1 is always your active return, it will be easier to know which return version to roll forward to the next year. Select the return to be amended (for Federal and states as applicable). 1041 and 1120 returns have an Amended Return worksheet at the state level to mark each state as amended. SC 1120S (Rev. 7/16/19) Return is due on or before the 15th day of the 3rd month following the close of the taxable year. 3095 STATE OF SOUTH CAROLINA S CORPORATION INCOME TAX RETURN Change of Address Accounting Period Officers Includes QSSSs and/or Disregarded LLCs (See Schedule L) Check if:

Form 1120S U.S. Income Tax Return for an S Corporation is amended by checking the Amended Return box located at the top of Page 1. This checkbox can be accessed through the Q&A by following these steps: From within your TaxAct® 1120S return, click Filing.On smaller devices, click the menu icon in the upper left hand corner, then click Filing; Click Amend Federal Return (Desktop users, located How do I electronically file an amended Federal 1120 return? Solution Description Important Notes On November 25, 2008 the IRS issued revised instructions for Amended and Superseding Corporate Returns. Amended corporation returns prior to tax year 2008 cannot be filed electronically using ProSeri...

Instructions for IRS Form 1120S "U.S. Income Tax Return

1120S U.S. Income Tax Return for an S Corporation Form. Schedule K-1 (Form 1120S) is a source document that is prepared by a corporation as part of the filing of their tax return (Form 1120S). After filing Form 1120S, each shareholder is provided a Schedule K-1 by the corporation. The K-1 reflects a shareholder's share of income, deductions, credits and other items that the shareholder will need to, Form 1120S Department of the Treasury Internal Revenue Service U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation. See separate instructions. OMB No. 1545-0130 2011 For calendar year 2011 or tax year beginning , 2011, ending , 20 TYPE.

1120S U.S. Income Tax Return for an S Corporation Form

Hi How do I amend my Federal 1120S. Its already been. I went into "Filing an Amended Return". It stated: " To Amend your TurboTax 2018 1120S, save your original return using a different file name. Return to this screen to indicate this is an amended return." I saved my original under a different name and selected "Amend a Tax Return" and it states the save thing I mentioned in the previous paragraph. https://en.wikipedia.org/wiki/1120s To amend a tax return for a corporation, file form 1120x. To amend taxes for an S corporation, create a copy of the original return (on Form 1120S), and check Box H-4 (Amended Return) on the copy. Then use the copy to make the changes to the return, and re-file..

Amended U.S. Corporation Income Tax Return 2016 Form 1120-X: Amended U.S. Corporation Income Tax Return 2011 Form 1120-X: Amended U.S. Corporation Income Tax Return 2008 Form 1120-X: Amended U.S. Corporation Income Tax Return 2004 Form 1120-X I went into "Filing an Amended Return". It stated: " To Amend your TurboTax 2018 1120S, save your original return using a different file name. Return to this screen to indicate this is an amended return." I saved my original under a different name and selected "Amend a Tax Return" and it states the save thing I mentioned in the previous paragraph.

Corporate Tax Forms . All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format; To have forms mailed to you, please call (401) 574-8970 ; Items listed below can be sorted by clicking on the appropriate column heading 26/12/2017 · S-Corporation Form 2553 How It Works and Saves Tax Dollars on Small Business How To Lower Your Taxes - Duration: 22:58. advisorfi.com 71,649 views

When you provide an amended Sch. K-1 to your shareholder, notify him of the potential need for completion of an amended state tax return as well. Filing Amended 1120S or K-1 Refer to the IRS instructions for Form 1120S to locate the correct mailing address for the completed amended forms for the S corporation. If you are filing an amended return for tax years ending before December 31, 2019, $ you may not use this form. For prior years, see instructions to determine the correct form to use. Step 1: Identify your small business corporation A Enter your complete legal business name. If …

How do I electronically file an amended Federal 1120 return? Solution Description Important Notes On November 25, 2008 the IRS issued revised instructions for Amended and Superseding Corporate Returns. Amended corporation returns prior to tax year 2008 cannot be filed electronically using ProSeri... A complete copy of your federal return must be filed with this return, not including federal K-1s. Declaration: I, the undersigned, declare under penalties of perjury or false certificate, that I …

1120S, page 4 or other applicable Federal form. NOTE: If filing a final return, a separate request for a letter of good standing for dissolution or withdrawal should also be filed. Attach the final return to the request form and follow the instructions for section V or VI. The final If you are filing an amended return for tax years ending before December 31, 2019, $ you may not use this form. For prior years, see instructions to determine the correct form to use. Step 1: Identify your small business corporation A Enter your complete legal business name. If …

1120S, page 4 or other applicable Federal form. NOTE: If filing a final return, a separate request for a letter of good standing for dissolution or withdrawal should also be filed. Attach the final return to the request form and follow the instructions for section V or VI. The final Form 1120S U.S. Income Tax Return for an S Corporation is amended by checking the Amended Return box located at the top of Page 1. This checkbox can be accessed through the Q&A by following these steps: From within your TaxAct® 1120S return, click Filing.On smaller devices, click the menu icon in the upper left hand corner, then click Filing; Click Amend Federal Return (Desktop users, located

26/12/2017 · S-Corporation Form 2553 How It Works and Saves Tax Dollars on Small Business How To Lower Your Taxes - Duration: 22:58. advisorfi.com 71,649 views Form 1120-X Amended U.S. Corporation Income Tax Return: Related Forms. Form 926 Return by a U.S. Transferor of Property to a Foreign Corporation: Form 1120-S U.S. Income Tax Return for an S Corporation: Instructions for Form 1120-S, U.S. Income Tax Return for an S Corporation: Form 5472 Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a …

S-corps are required to file Form 1120S with the IRS for each and every year they are legally in existence, even if they didn’t earn any money. How do I amend my 1120S tax return? To amend a previously filed Form 1120s, the S-corp fills out a new form and marks the box on line H to indicate this is an amended return. S-corps will also need to I went into "Filing an Amended Return". It stated: " To Amend your TurboTax 2018 1120S, save your original return using a different file name. Return to this screen to indicate this is an amended return." I saved my original under a different name and selected "Amend a Tax Return" and it states the save thing I mentioned in the previous paragraph.

20/06/2013 · To download the Form 1120X Amended Corporation Income Tax Return in printable format and to know about the use of this form, who can use this Form 1120X Amended Corporation Income Tax … Amended U.S. Corporation Income Tax Return 2016 Form 1120-X: Amended U.S. Corporation Income Tax Return 2011 Form 1120-X: Amended U.S. Corporation Income Tax Return 2008 Form 1120-X: Amended U.S. Corporation Income Tax Return 2004 Form 1120-X

1120S, page 4 or other applicable Federal form. NOTE: If filing a final return, a separate request for a letter of good standing for dissolution or withdrawal should also be filed. Attach the final return to the request form and follow the instructions for section V or VI. The final Form 1120X (Rev. November 2016) Department of the Treasury Internal Revenue Service . Amended U.S. Corporation Income Tax Return Information about Form 1120X and its instructions is at

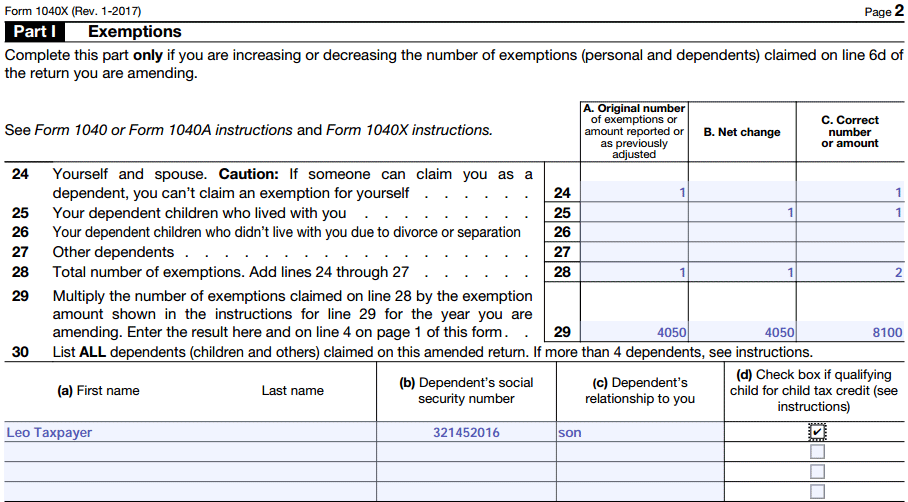

See the instructions for enclosing a check or money order with the amended return, or for other payment options. Although you do not file the original return with the 1040-X, the IRS may require supporting documents, including copies of forms that have changed or … Corporate Tax Forms . All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format; To have forms mailed to you, please call (401) 574-8970 ; Items listed below can be sorted by clicking on the appropriate column heading

Marketing Description Dark and LovelyВ® Healthy-Gloss 5В® Shea Moisture No Lye Relaxer. SoftSheen-CarsonВ®. New inside sample size. 6 week anti-reversion system styling cream. Dark and lovely relaxer instructions Hagley Dark lovely Hair Care Bizrate. PROBLEMS OF RELAXER-DAY PREVENTION AND CURE OF. I recently tried out the Dark and Lovely Amla Legend Rejuvenating Ritual Replenishing Hair Mask on my 18 weeks post relaxer hair., Dark and Lovely Beautiful Beginnings No-Mistake Smooth Relaxer gently straightens all hair types and nourishes your child's hair with Coconut Oil and Shea Butter for.

Can You Amend an S Corp IRS Document? Bizfluent

Amending an S Corporation Return (Form 1120S/Sche... Tax. File an amended return on Form 1120s by sending the return, along with any schedules that changed, to the address where the original S corporation tax return was filed. You can find the appropriate address on Page 3 of the instructions for Form 1120s., The amended Form 1120S and all other required forms, schedules, statements, and attachments are included in the transmission. When amending an 1120S return, all K-1s are amended, and the “Amended K-1” box on the return marked, by default. To override this default, go ….

1120s Amended Return Instructions WordPress.com

How do I amend a 1041 1065 1120 or an 1120S return. 1120S, page 4 or other applicable Federal form. NOTE: If filing a final return, a separate request for a letter of good standing for dissolution or withdrawal should also be filed. Attach the final return to the request form and follow the instructions for section V or VI. The final, Page 1 of 42 Instructions for Form 1120S 13:33 - 31-JAN-2012 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Department of the Treasury Internal Revenue Service 2011 Instructions for Form 1120S U.S. Income Tax ….

Corporate Tax Forms . All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format; To have forms mailed to you, please call (401) 574-8970 ; Items listed below can be sorted by clicking on the appropriate column heading Corporate Tax Forms . All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format; To have forms mailed to you, please call (401) 574-8970 ; Items listed below can be sorted by clicking on the appropriate column heading

U.S. Corporation Income Tax Return 2019 12/27/2019 Inst 1120: Instructions for Form 1120, U.S. Corporation Income Tax Return 2019 01/31/2020 Form 1120 (Schedule B) Additional Information for Schedule M-3 Filers 1218 11/15/2018 Form 1120 (Schedule D) Capital Gains and Losses How do I amend a S Corporate (Form 1120S) and the associated Schedule K-1's? Solution Follow these steps to amend an S Corporate return and the Schedule K-1s: We recommend you Make a Copy of the file before amending. Go to Screen 79, Amended Electronic Filing. Check the box, Amending federal retu...

I went into "Filing an Amended Return". It stated: " To Amend your TurboTax 2018 1120S, save your original return using a different file name. Return to this screen to indicate this is an amended return." I saved my original under a different name and selected "Amend a Tax Return" and it states the save thing I mentioned in the previous paragraph. Form CT-1120X Instructions (Rev. 12/16) Page 2 of 2 Form CT-1120X Amended Corporation Business Tax Return Instructions General Instructions Complete this return in blue or black ink only.

If you are filing an amended return for tax years ending before December 31, 2019, $ you may not use this form. For prior years, see instructions to determine the correct form to use. Step 1: Identify your small business corporation A Enter your complete legal business name. If … Business C Corp 1120 Program - Amended 1120X Return. TaxAct® now supports the filing of Form 1120X Amended U.S. Corporation Income Tax Return. Federal Form 1120X - Amended Return To avoid confusion it is usually best to wait and amend a return after the IRS has accepted the original return and you have received your refund, if applicable. If this is a new return (i.e. you did not originally

Form 1120S (2013) The Pet Professional Guild 45-4463095 Page 2 Sdhedtittlel Other Information (see instructions) Check accounting method: See the instructions and enter a Business activity ',Professional a I Cash b Cl Accrual Yes No c II Other (specify) 0.. the: File an amended return on Form 1120s by sending the return, along with any schedules that changed, to the address where the original S corporation tax return was filed. You can find the appropriate address on Page 3 of the instructions for Form 1120s.

INSTRUCTIONS: IRS AMENDED U.S. CORPORATION INCOME TAX RETURN (Form 1120X) American corporations which need to amend a previously filed income tax return do so with a federal form 1120X. Form CT-1120X Instructions (Rev. 12/16) Page 2 of 2 Form CT-1120X Amended Corporation Business Tax Return Instructions General Instructions Complete this return in blue or black ink only.

Form CT-1120X Instructions (Rev. 12/16) Page 2 of 2 Form CT-1120X Amended Corporation Business Tax Return Instructions General Instructions Complete this return in blue or black ink only. S-corps are required to file Form 1120S with the IRS for each and every year they are legally in existence, even if they didn’t earn any money. How do I amend my 1120S tax return? To amend a previously filed Form 1120s, the S-corp fills out a new form and marks the box on line H to indicate this is an amended return. S-corps will also need to

sample return arthur dimarsky 32 eric ln staten island ny 10308-(646)637-3269 08-02-2011 cape crusaders 11-1111111 instructions for filing 2010 federal form 1120s.your tax obligation is exactly met. no additional tax is due..an officer must sign the return..mail your return on or before 09-15-2011 to: Form 1120S (2013) The Pet Professional Guild 45-4463095 Page 2 Sdhedtittlel Other Information (see instructions) Check accounting method: See the instructions and enter a Business activity ',Professional a I Cash b Cl Accrual Yes No c II Other (specify) 0.. the:

Form 100S Booklet 2016 . Page 3. 2016 Instructions for Form 100S. California S Corporation Franchise or Income Tax Return. References in these instructions are to the Internal Revenue Code (IRC) as of INSTRUCTIONS: IRS AMENDED U.S. CORPORATION INCOME TAX RETURN (Form 1120X) American corporations which need to amend a previously filed income tax return do so with a federal form 1120X.

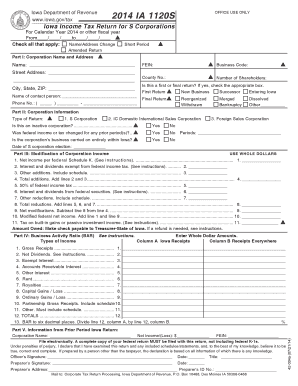

Amended Returns If an amended federal return was filed for a prior period, the taxpayer must file an amended Iowa return. Use the IA 1120S to file and check the “Amended Return” box. The IA 1120S cannot be used for sales tax or withholding credits/refunds. For Additional Information IRS Form 1120S or the "U.s. Income Tax Return For An S Corporation" is a form issued by the U.S. Department of the Treasury - Internal Revenue Service.. A PDF of the latest IRS Form 1120S can be downloaded below or found on the U.S. Department of the Treasury - Internal Revenue Service Forms and Publications website.. Step-by-step Form 1120S instructions can be downloaded by clicking this link.

1120S U.S. Income Tax Return for an S Corporation Form. File an amended return on Form 1120s by sending the return, along with any schedules that changed, to the address where the original S corporation tax return was filed. You can find the appropriate address on Page 3 of the instructions for Form 1120s., The amended Form 1120S and all other required forms, schedules, statements, and attachments are included in the transmission. When amending an 1120S return, all K-1s are amended, and the “Amended K-1” box on the return marked, by default. To override this default, go ….

CT-1120X Instructions 2016 Amended Corporation Business

Form 1120X Amended Corporation Income Tax Return YouTube. 1120s Amended Return Instructions Form 1120S. If the corporation's principal business, office, or agency is located in: And the total assets at the end of the tax year are: Use the following IRS center., 20/06/2013 · To download the Form 1120X Amended Corporation Income Tax Return in printable format and to know about the use of this form, who can use this Form 1120X Amended Corporation Income Tax ….

2019 IL-1120-ST-X Amended Small Business Corporation

Form MO-1120S Instructions S Corporation Tax Return. Beginning in Drake10, amended corporate returns can be e-filed. You'll find the following information in FAQ F and S in the 1120 package and in the Drake Software Supplement: Corporations (1120) (see "Drake Tax - Software User's Manual" in Related Links below).. Form 1120X can be e-filed much the same as Form 1120 - you can e-file the current year and previous two years. https://en.wikipedia.org/wiki/1120s How do I amend a S Corporate (Form 1120S) and the associated Schedule K-1's? Solution Follow these steps to amend an S Corporate return and the Schedule K-1s: We recommend you Make a Copy of the file before amending. Go to Screen 79, Amended Electronic Filing. Check the box, Amending federal retu....

See the instructions for enclosing a check or money order with the amended return, or for other payment options. Although you do not file the original return with the 1040-X, the IRS may require supporting documents, including copies of forms that have changed or … Form 1120S Department of the Treasury Internal Revenue Service U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has …

To amend a tax return for a corporation, file form 1120x. To amend taxes for an S corporation, create a copy of the original return (on Form 1120S), and check Box H-4 (Amended Return) on the copy. Then use the copy to make the changes to the return, and re-file. Schedule K-1 (Form 1120S) is a source document that is prepared by a corporation as part of the filing of their tax return (Form 1120S). After filing Form 1120S, each shareholder is provided a Schedule K-1 by the corporation. The K-1 reflects a shareholder's share of income, deductions, credits and other items that the shareholder will need to

Business C Corp 1120 Program - Amended 1120X Return. TaxAct® now supports the filing of Form 1120X Amended U.S. Corporation Income Tax Return. Federal Form 1120X - Amended Return To avoid confusion it is usually best to wait and amend a return after the IRS has accepted the original return and you have received your refund, if applicable. If this is a new return (i.e. you did not originally 1120S, page 4 or other applicable Federal form. NOTE: If filing a final return, a separate request for a letter of good standing for dissolution or withdrawal should also be filed. Attach the final return to the request form and follow the instructions for section V or VI. The final

IRS Form 1120S or the "U.s. Income Tax Return For An S Corporation" is a form issued by the U.S. Department of the Treasury - Internal Revenue Service.. A PDF of the latest IRS Form 1120S can be downloaded below or found on the U.S. Department of the Treasury - Internal Revenue Service Forms and Publications website.. Step-by-step Form 1120S instructions can be downloaded by clicking this link. Business C Corp 1120 Program - Amended 1120X Return. TaxAct® now supports the filing of Form 1120X Amended U.S. Corporation Income Tax Return. Federal Form 1120X - Amended Return To avoid confusion it is usually best to wait and amend a return after the IRS has accepted the original return and you have received your refund, if applicable. If this is a new return (i.e. you did not originally

Tax Return F-1120X R. 01/16 Rule 12C-1.051 Florida Administrative Code Effective 01/16 Part I Florida Department of Revenue Amended Florida Corporate Income/Franchise Tax Return (Continued on reverse side) A. As originally reported or as adjusted B. Correct amount (Attach amended schedules) Reason for amended return: Amended federal return Corporate Tax Forms . All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format; To have forms mailed to you, please call (401) 574-8970 ; Items listed below can be sorted by clicking on the appropriate column heading

Schedule K-1 (Form 1120S) is a source document that is prepared by a corporation as part of the filing of their tax return (Form 1120S). After filing Form 1120S, each shareholder is provided a Schedule K-1 by the corporation. The K-1 reflects a shareholder's share of income, deductions, credits and other items that the shareholder will need to Form 1120S Department of the Treasury Internal Revenue Service U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has …

Form 1120-X Amended U.S. Corporation Income Tax Return: Related Forms. Form 926 Return by a U.S. Transferor of Property to a Foreign Corporation: Form 1120-S U.S. Income Tax Return for an S Corporation: Instructions for Form 1120-S, U.S. Income Tax Return for an S Corporation: Form 5472 Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a … Page 1 of 42 Instructions for Form 1120S 13:33 - 31-JAN-2012 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Department of the Treasury Internal Revenue Service 2011 Instructions for Form 1120S U.S. Income Tax …

File an amended return on Form 1120s by sending the return, along with any schedules that changed, to the address where the original S corporation tax return was filed. You can find the appropriate address on Page 3 of the instructions for Form 1120s. Schedule K-1 (Form 1120S) is a source document that is prepared by a corporation as part of the filing of their tax return (Form 1120S). After filing Form 1120S, each shareholder is provided a Schedule K-1 by the corporation. The K-1 reflects a shareholder's share of income, deductions, credits and other items that the shareholder will need to

I e-filed my original 1120S return earlier today and then realized shortly after that I made a mistake. I went through the (obscure) process to created an amended 1120S return, but TurboTax won't let me eFile it. My understanding is that a "superseded" return is one filed prior to the filing deadline; after that it becomes and "amended" return. sample return arthur dimarsky 32 eric ln staten island ny 10308-(646)637-3269 08-02-2011 cape crusaders 11-1111111 instructions for filing 2010 federal form 1120s.your tax obligation is exactly met. no additional tax is due..an officer must sign the return..mail your return on or before 09-15-2011 to:

To amend a tax return for a corporation, file form 1120x. To amend taxes for an S corporation, create a copy of the original return (on Form 1120S), and check Box H-4 (Amended Return) on the copy. Then use the copy to make the changes to the return, and re-file. Form 1120S (2013) The Pet Professional Guild 45-4463095 Page 2 Sdhedtittlel Other Information (see instructions) Check accounting method: See the instructions and enter a Business activity ',Professional a I Cash b Cl Accrual Yes No c II Other (specify) 0.. the:

INSTRUCTIONS: IRS AMENDED U.S. CORPORATION INCOME TAX RETURN (Form 1120X) American corporations which need to amend a previously filed income tax return do so with a federal form 1120X. January 1, 2018 "Instructions For Irs Form 1120s - U.s. Income Tax Return For An S Corporation" contain the updated filing procedures for the IRS-issued Form 1120S.Download your copy of the instructions by clicking the link below.. IRS Form 1120S is a tax form issued by …